Reportable Tax Position Schedule 2024 – The tax practitioner uses her knowledge of the client and the client’s business, reviews the report from the third-party provider, applies the statute, evaluates the IRS’s position explained in its . Getting audited on your taxes is a common fear among taxpayers. Fortunately, the IRS only audited 3.8 out of every 1,000 returns, or 0.38%, during the fiscal year 2022, according to a .

Reportable Tax Position Schedule 2024

Source : koinly.io2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgBetsy Ann Howe posted on LinkedIn

Source : www.linkedin.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgUS Taxes for Foreign LLC Owners: A Simple Guide to Filing

Source : oandgaccounting.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgHow to Become a Certified Acceptance Agent in 2024 O&G Tax and

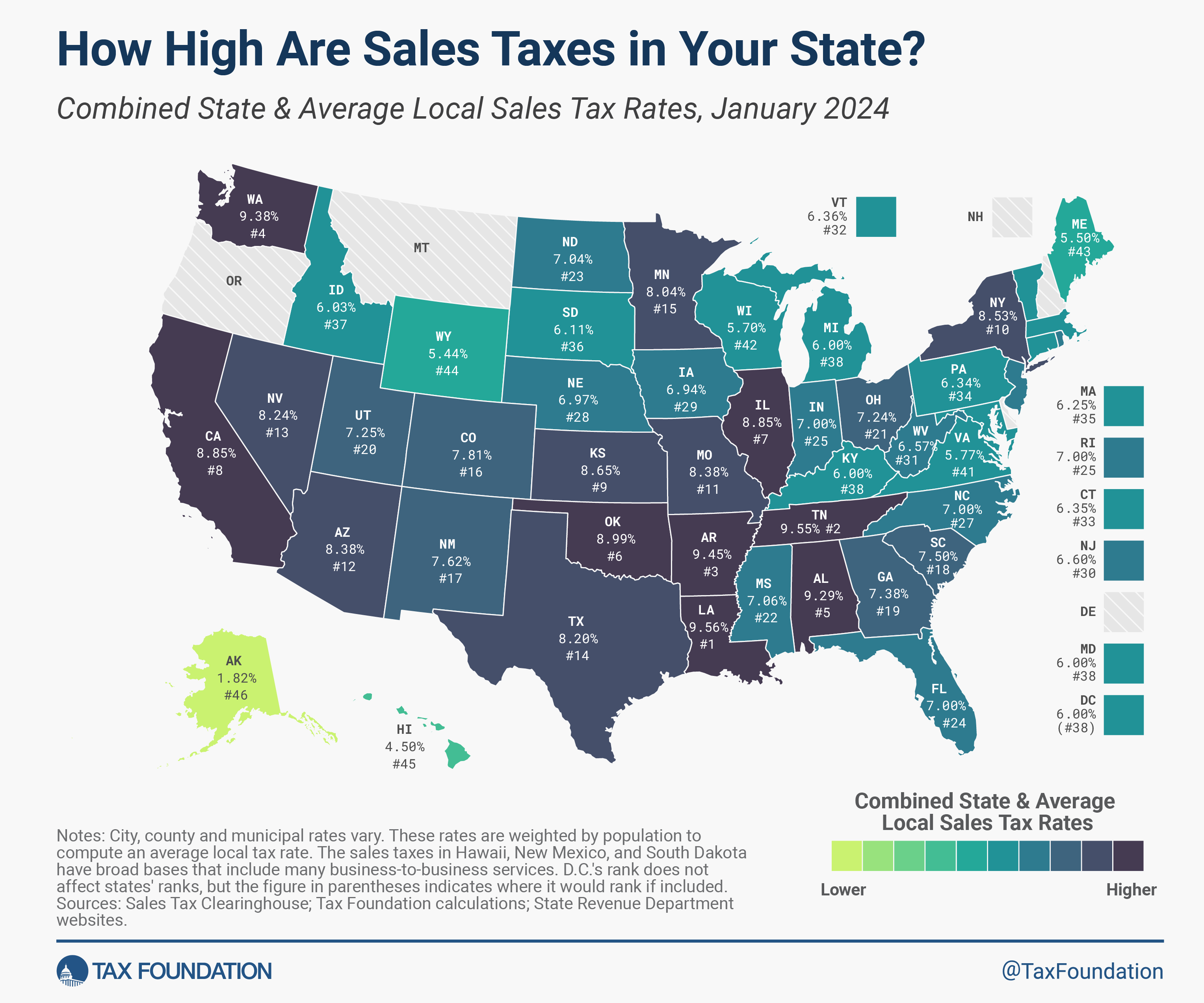

Source : oandgaccounting.com2024 Sales Tax Rates: State & Local Sales Tax by State

Source : taxfoundation.orgPay Less Crypto Tax in 2024 (Legally!) | Koinly

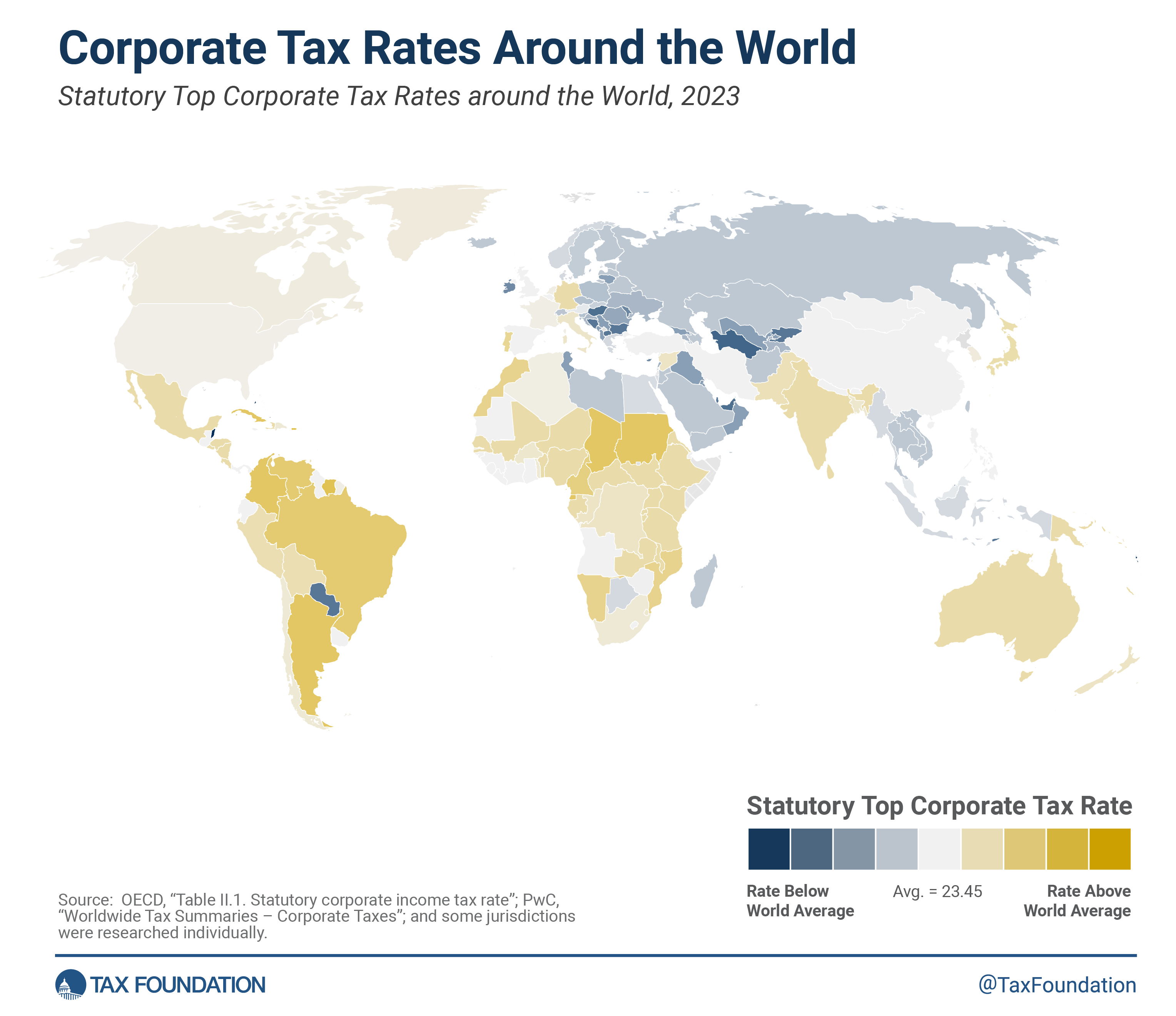

Source : koinly.ioCorporate Tax Rates around the World, 2023

Source : taxfoundation.orgReportable Tax Position Schedule 2024 Crypto Tax Switzerland: 2024 Guide | Koinly: Our mission is to help you make informed financial decisions, and we hold ourselves to strict editorial guidelines . This post may contain links to products from our partners, which may earn us . This ensures that tax calculations align with the appropriate reporting standards. Koinly provides a complimentary plan that imposes a cap on the number of transactions at 10,000. Nevertheless, this .

]]>